What is Bootstrapping?

Bootstrapping means funding your business using personal funds, operational cash flow, family contributions, pre-order revenues, invoice financing, and similar methods.

Bootstrapping enables you to stay sustainable on your own resources while maintaining full control over business decisions.

Challenges arise in scaling operations, taking significant risks, or hiring expensive talent due to limited capital. Bootstrapping demands a balance between financial discipline and innovative problem-solving to grow the business sustainably.

How Does Bootstrapping Work?

Bootstrapping a business involves a practical and disciplined approach to utilizing available resources for growth. It starts with personal savings, often serving as the initial capital to cover early expenses like product development or marketing. Founders need to allocate these funds carefully, prioritizing essentials over luxuries. For example, instead of renting an expensive office, many entrepreneurs begin working from home or shared spaces to save costs.

Early revenue generation is crucial in bootstrapping. Businesses must focus on products or services that can start bringing in cash quickly. Pre-orders or subscription models are popular techniques, as they provide upfront funding to finance production or service delivery. For instance, Pebble Watch raised millions in pre-orders to fund its operations, proving how a customer-centric approach can sustain a business without external capital.

Once the revenue starts flowing, the key is to reinvest profits back into the business. Instead of drawing high salaries or splurging on non-critical areas, bootstrapped entrepreneurs channel earnings into core functions like marketing, scaling operations, or improving product quality. This reinvestment cycle drives organic growth but requires patience and a long-term mindset to see tangible results.

Entrepreneurs often rely on free or affordable tools for marketing, customer management, or operations. Platforms like Canva, Mailchimp, or Trello allow startups to operate efficiently without hefty expenditures. Additionally, negotiating credit terms with suppliers, such as deferred payments, helps manage cash flow during lean periods.

Unlike funded businesses, bootstrapped startups must navigate uncertainties without a financial safety net. Founders need to stay flexible, learn from failures, and constantly pivot based on market needs. With this mindset, many bootstrapped businesses, like Spanx, have transformed challenges into opportunities, proving that financial constraints can fuel creativity and innovation.

Pros and Cons of Bootstrapping

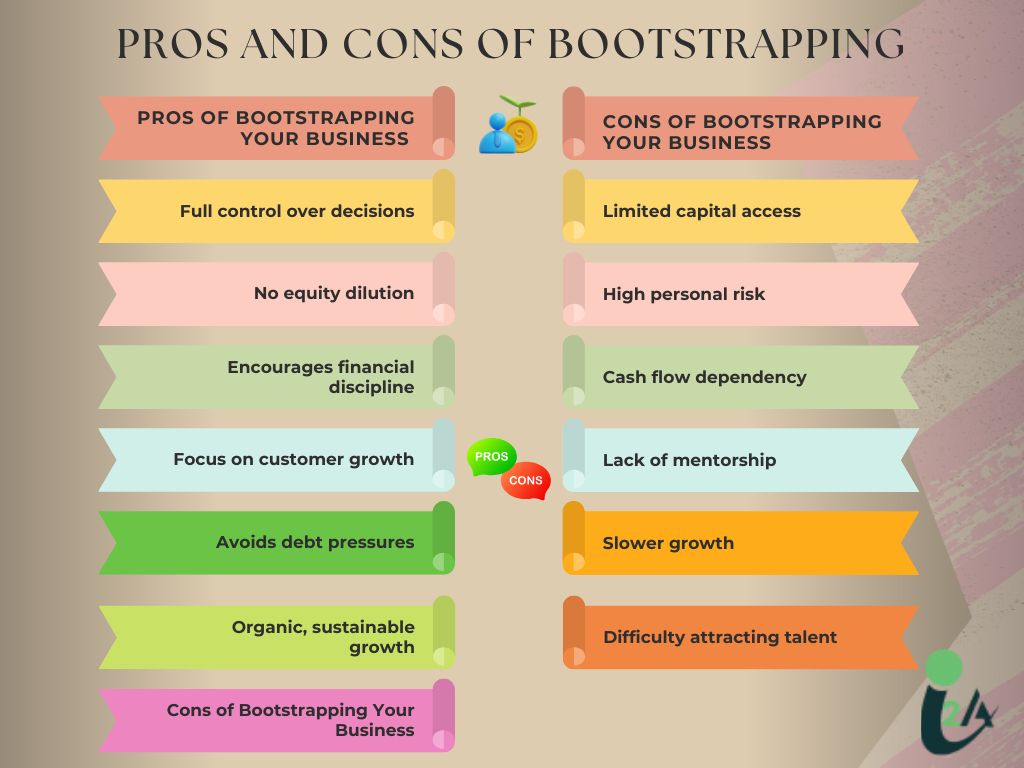

Pros of Bootstrapping Your Business

- Full control over decision-making and business direction.

- No equity dilution, allowing founders to retain 100% ownership.

- Encourages financial discipline and efficient resource management.

- Focuses on customer-driven growth and building loyalty.

- Avoids debt and external repayment pressures.

- Allows organic, sustainable growth at the founder’s pace.

Cons of Bootstrapping Your Business

- Limited access to capital restricts rapid scaling and market expansion.

- High personal financial risk, often tied to savings or assets.

- Cash flow dependency increases vulnerability to delays in payments.

- Lack of access to industry networks and mentorship often tied to investors.

- Slower growth compared to funded competitors.

- Difficulty in attracting top talent due to budget constraints.

Bootstrapping vs Capital Raise

Capital raising involves acquiring funds from external sources like angel investors, private equity, or issuing equity to grow the business. These funds are often sought to scale operations, launch new products, or enter new markets. Capital raises generally require founders to dilute ownership in exchange for financial support, which can accelerate growth significantly.

With a capital raise, businesses gain access to significant funding that can support rapid scaling, high-value hires, and substantial marketing campaigns. Unlike bootstrapping, capital raising provides the cushion to take calculated risks without immediate cash flow concerns. For startups in highly competitive industries, it offers an edge by ensuring quicker entry and better resources.

Raising capital involves preparing detailed business plans, financial projections, and pitches to attract investors. The process often begins with networking or reaching out to angel investors and private equity firms. In the U.S., platforms like AngelList and firms like Andreessen Horowitz, Sequoia Capital, and Accel are prominent players that invest in promising startups.

Amit Chauhan the CEO and Founder of I2A Technologies, who has been a successful bootstrapped entrepreneur, shares his insights and say, “As someone who has bootstrapped multiple ventures, I believe capital raising can be alluring but comes at the cost of control and independence. Bootstrapping teaches resilience and forces you to focus on creating value for your customers from day one. While capital raising provides instant growth, it often means compromising your vision to meet investor expectations. For me, the freedom to experiment and innovate without external pressure has been the cornerstone of my entrepreneurial journey.”

Bootstrapping vs Pre-Seed Funding

Pre-seed funding refers to the initial capital raised to validate a business idea, often before the product or service is fully developed. This stage typically involves friends, family, or angel investors contributing small amounts to help founders build a prototype or conduct market research.

Pre-seed funding allows founders to get started without exhausting personal savings, offering financial stability during the ideation stage. It provides the resources needed for initial development, like hiring a small team, conducting surveys, or running marketing tests, which can be challenging for bootstrapped ventures.

Pre-seed funding usually comes from personal connections or angel investors who invest in exchange for a small equity stake. Platforms like AngelList and accelerators like Y Combinator are popular avenues for early-stage funding. The average pre-seed funding ranges from $50,000 to $250,000, depending on the business model and market potential.

Amit Chauhan shares that bootstrapping is also a personal growth for a businessman, he shares, “Pre-seed funding can give startups a helpful nudge, but I’ve found bootstrapping to be a more rewarding experience. It forces you to deeply understand your market, operate lean, and grow with your customers. In my case, relying on bootstrapping meant I could launch without being tied to investor demands or fixed timelines. The focus remained on building something sustainable, not just hitting growth milestones.”

Bootstrapping vs Venture Capital

Venture capital (VC) involves funding from professional investors who provide large sums of money in exchange for equity. VCs typically fund startups with high growth potential and often play an active role in scaling the business through mentorship, connections, and strategic guidance.

Venture capital offers significant resources to fuel rapid scaling, enter global markets, and hire top-tier talent. Unlike bootstrapping, VC funding enables businesses to take risks on ambitious projects, such as expensive R&D or aggressive marketing campaigns. Additionally, VCs bring industry expertise and access to valuable networks.

Securing VC funding requires a well-developed business plan and substantial traction or market potential. Founders pitch to VC firms, competing for investment. In the U.S., firms like Sequoia Capital, Andreessen Horowitz, and Greylock Partners are industry leaders, investing in startups like Airbnb, Uber, and Slack.

An ability to make independent decisions empowers business leaders and that where the Founder and CEO of I2A Technologies, Amit Chauhan says, “Venture capital offers a fast track to scaling, but it often means giving up autonomy. As a bootstrapping advocate, I’ve learned to value the independence and direct connection with my customers. With no external investors, I’ve had the freedom to experiment, pivot, and focus on long-term sustainability instead of short-term growth targets. Bootstrapping might take longer, but the control and satisfaction it provides are unmatched.”

Bootstrapping vs Other Funding Options

Bootstrapping stands apart from traditional funding methods like loans and crowdfunding due to its emphasis on self-reliance and financial discipline. While loans provide immediate access to significant capital, they come with high interest rates and rigid repayment terms. This can be particularly risky during economic slowdowns or recessions, where cash flow disruptions may lead to defaults. In such scenarios, bootstrapping offers a safer alternative, as businesses operate within their means without the burden of debt.

Crowdfunding, on the other hand, allows startups to raise funds from a large number of backers in exchange for rewards or equity. While this can help businesses gain visibility and upfront capital, it also creates obligations to deliver on promises, which can strain resources. Bootstrapping avoids such complexities, enabling entrepreneurs to focus on sustainable growth rather than meeting the expectations of numerous stakeholders.

Another critical advantage of bootstrapping is the control it offers. Unlike funded ventures where investors may dictate strategic decisions, bootstrapped businesses retain full autonomy. This independence is invaluable when navigating uncertain economic conditions, allowing founders to pivot quickly without external pressures. Although bootstrapping requires patience and resourcefulness, it fosters resilience, enabling businesses to weather financial challenges without the added risks of debt or stakeholder demands.

In times of economic instability, bootstrapping emerges as a pragmatic approach. By relying on internal resources and disciplined spending, businesses can build a strong foundation that prioritizes long-term stability over short-term gains, ensuring they remain adaptable and solvent regardless of market fluctuations.

Choosing the Right Path

Choosing between bootstrapping and external funding depends on your business goals, available resources, and risk tolerance. Bootstrapping is ideal for entrepreneurs who value independence, control, and sustainable growth. It requires a lean business model, strong cash flow management, and a customer-focused approach.

Bootstrapping is more than a funding choice—it’s a mindset and a strategy. It demands discipline, resilience, and creativity to maximize resources and prioritize essentials. To succeed, you must have a clear vision, patience for slower growth, and a willingness to embrace challenges while staying adaptable. It’s not just how you fund your business but how you operate it for long-term success.

Amit Chauhan on Bootstrapping emphasises:

“As a founder who’s walked the bootstrapping path, I’ve learned that building a business isn’t about chasing quick wins or making a fast buck—it’s about crafting something meaningful, sustainable, and true to your vision. Selling equity too early might seem tempting, but it often comes at the cost of your autonomy and long-term goals. Bootstrapping teaches you patience, resilience, and how to run lean, customer-focused operations. It’s not just a funding strategy; it’s a commitment to your passion and a belief in your business’s potential. Remember, great businesses are not built overnight. Stick to your values, build smartly, and grow at your pace—it’s the journey, not just the destination, that defines success.”

Publisher

Publisher