What is Bootstrapping?

Bootstrapping is the art of building a business with what you have—your savings, early revenues, and a lot of creativity. It’s about rolling up your sleeves, thinking resourcefully, and growing organically without external funding. You retain full control, make every dollar count, and let your customers drive your success. Think of Spanx or Mailchimp—both began as bootstrapped ventures, proving that determination and ingenuity can outshine deep pockets. It’s not just a funding strategy; it’s a mindset that fosters resilience, independence, and sustainable growth.

Why Choose Bootstrapping?

Bootstrapping allows entrepreneurs to retain full ownership and control of their business, making decisions without external interference. It fosters financial discipline, as every dollar spent must be justified, ensuring lean and efficient operations. By relying on organic growth and customer revenue, bootstrapped businesses develop a stronger focus on delivering value and building loyal customer relationships.

This approach also minimizes financial risk, avoiding debt or equity dilution. Entrepreneurs learn to innovate within constraints, often leading to creative solutions and a resilient business model. For example, Mailchimp’s bootstrapped growth allowed it to remain independent and customer-focused for over two decades.

Bootstrapping is ideal for those who value independence and want to grow sustainably at their own pace. While it demands hard work and resourcefulness, it builds a solid foundation for long-term success without the pressures of external funding.

How to Bootstrap Your Startup?

Bootstrapping your startup requires a strategic mindset and resourceful execution. With limited resources, every decision must be intentional, balancing immediate needs with long-term goals. Here’s a step-by-step guide to help you bootstrap effectively:

Start with a Clear and Scalable Business Idea

A solid business idea is the foundation of any bootstrapped venture. Focus on solving a real problem or fulfilling an unmet need in the market. The idea should also have potential for scalability, even with minimal resources. For example, Mailchimp began as a side project, offering email marketing tools to small businesses. By focusing on a scalable solution, it grew into a billion-dollar enterprise without external funding.

Leverage Personal and Family Resources Wisely

In the early stages, personal savings and loans from friends or family often serve as the primary funding sources. While these funds provide flexibility, it’s essential to use them prudently. Create a lean budget and avoid overspending on non-essential items. Sara Blakely, the founder of Spanx, started her company with just $5,000 in savings, using it efficiently to prototype and market her product.

Focus on Generating Cash Flow Early

Revenue is the lifeline of a bootstrapped business. Begin with products or services that can generate income quickly, even if they’re not your ultimate vision. For instance, many SaaS companies start with basic offerings and add advanced features as revenue grows. Reinvest profits directly into the business to fuel growth.

Keep Costs Low and Prioritize Needs

Operate lean by avoiding unnecessary expenses. Use free or affordable tools for marketing, accounting, and customer management. For example, tools like Canva, Mailchimp, and Trello offer robust free plans that help startups manage design, email campaigns, and projects without breaking the bank. Negotiate with suppliers and vendors to secure favorable terms, deferring payments wherever possible.

Build a Strong Customer-Centric Model

Your customers are your primary source of funding in a bootstrapped business. Focus on delivering exceptional value and building strong relationships. Offering pre-orders or subscription models can help generate upfront revenue to cover production costs. For example, Pebble Watch raised funds through pre-orders on Kickstarter, providing a cash influx while maintaining control of the business.

Network and Seek Mentorship

Building a strong network can open doors to partnerships, advice, and resources. Join entrepreneurial communities, attend local business events, and connect with mentors who can provide guidance without financial strings attached. Many successful bootstrapped founders credit their networks for helping them navigate challenges and seize opportunities.

Reinvest Profits for Growth

Instead of drawing significant salaries or distributing profits early, reinvest earnings back into the business. This approach ensures sustained growth and strengthens your financial position. The founders of GoPro reinvested early profits to improve their products and expand distribution channels, eventually leading to global success.

Use Creative Financing Techniques

Explore innovative financing options like invoice financing, merchant cash advances, or operating on credit with suppliers. These methods can provide working capital without taking on debt or giving away equity. For instance, many small manufacturers operate on credit terms with their suppliers, allowing them to manage cash flow effectively.

Adapt and Pivot When Necessary

Bootstrapped startups need to be agile. Stay attuned to market feedback and be ready to pivot if your initial idea doesn’t work out. The founders of Instagram initially launched a location-based app called Burbn before pivoting to the photo-sharing platform that became a global success.

Stay Resilient and Patient

Bootstrapping is a marathon, not a sprint. Success often requires patience, perseverance, and adaptability. Accept that growth will likely be slower than with external funding, but the independence and control you retain are invaluable.

Best Bootstrapping Techniques

Bootstrapping requires a combination of creativity and resourcefulness to fund and sustain your business. Here are some of the best techniques to maximize efficiency and growth without external funding:

Pre-Order Sales

Pre-orders involve selling your product or service before it’s fully developed. This technique generates upfront cash flow, which can be used to fund production or delivery. For example, Pebble Watch raised over $10 million through pre-orders on Kickstarter. To implement this, create a compelling pitch for your target audience, ensure clear delivery timelines, and use platforms like Kickstarter or your website to manage orders.

Operating on Credit

Negotiating credit terms with suppliers allows businesses to defer payments, freeing up cash flow for other immediate needs. Many retail and manufacturing startups use this method to maintain inventory without upfront costs. To do this effectively, build strong relationships with suppliers and negotiate terms that allow for longer payment cycles without penalties.

Reinvesting Profits

Instead of drawing a salary or distributing earnings, reinvest your profits into the business to fund operations and growth. This approach was famously used by Mailchimp, which grew without external funding for over 20 years. Start by identifying priority areas, such as marketing or product development, and allocate profits accordingly to maximize returns.

Invoice Financing

This involves borrowing against unpaid invoices to access immediate cash flow. It’s particularly useful for businesses facing delays in payments from clients. To use this method, work with invoice financing providers who offer advances on outstanding invoices, ensuring you can cover expenses while waiting for receivables.

Subscription Models

Offering subscription services provides predictable, recurring revenue. SaaS businesses, like Netflix in its early days, used this model to generate steady cash flow. Implement this by creating tiered pricing plans that cater to different customer needs, ensuring affordability and value while maintaining consistent income streams.

Bartering

Bartering involves trading goods or services instead of cash payments. For example, a graphic designer might trade branding services with a tech startup in exchange for software. To barter effectively, identify complementary businesses and negotiate mutually beneficial agreements that align with your needs.

Lean Operations

Running lean means prioritizing essential expenses and eliminating unnecessary costs. Focus on tools, resources, and processes that directly impact your bottom line. For instance, many startups use free or low-cost tools like Google Workspace and Slack to manage operations efficiently.

Renting Instead of Buying

Rather than purchasing expensive equipment or office space, consider renting to reduce upfront costs. Many startups rent coworking spaces or lease equipment to keep overheads low. Evaluate your operational needs and opt for rental agreements that allow flexibility and scalability.

9. Outsourcing Non-Core Functions

Outsourcing tasks like accounting, IT, or customer service can reduce payroll expenses while maintaining quality. Companies like Basecamp have relied on outsourcing during their early stages to remain lean. Identify non-core functions and work with reliable third-party providers to handle them cost-effectively.

Crowdsourcing Contributions

While technically not traditional bootstrapping, crowdsourcing small contributions from supporters can provide initial funding without giving up equity. Platforms like GoFundMe or Indiegogo allow businesses to raise funds while creating community engagement. To succeed, create compelling campaigns that resonate with your target audience and emphasize the value they’ll receive.

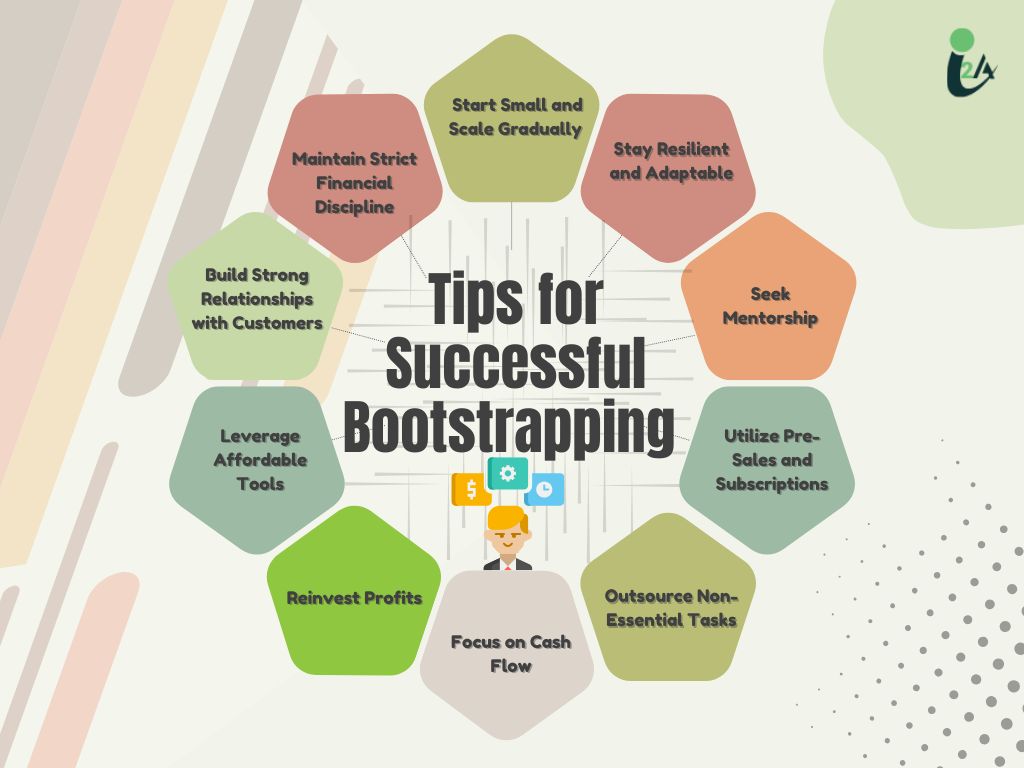

Tips for Successful Bootstrapping

- Start Small and Scale Gradually: Focus on building a minimum viable product (MVP) to test your idea, then expand as you generate revenue.

- Maintain Strict Financial Discipline: Track every expense and prioritize spending on essential areas like operations and customer acquisition.

- Build Strong Relationships with Customers: Engage directly with customers to understand their needs and ensure loyalty, which drives steady cash flow.

- Leverage Affordable Tools: Use free or low-cost tools for marketing, project management, and communication to reduce operational costs.

- Reinvest Profits: Channel earnings back into the business to fund growth instead of drawing large salaries or unnecessary distributions.

- Focus on Cash Flow: Keep a close eye on receivables and payables. Invoice promptly, negotiate favorable terms, and manage payment schedules wisely.

- Outsource Non-Essential Tasks: Delegate functions like accounting or IT to affordable freelancers or agencies to maintain focus on core activities.

- Utilize Pre-Sales and Subscriptions: Generate upfront revenue by offering pre-orders or subscription-based models for recurring income.

- Seek Mentorship: Connect with experienced entrepreneurs who can provide advice, support, and potential collaboration opportunities.

- Stay Resilient and Adaptable: Be prepared to pivot if market conditions change or if your initial approach isn’t working, maintaining a growth mindset.

Amit Chauhan’s Point of View

Bootstrapping is a journey of resilience, creativity, and discipline. By leveraging personal resources, focusing on customer-driven growth, and embracing lean operations, entrepreneurs can build sustainable businesses while retaining control. It’s a challenging path but one that cultivates independence and long-term success.

Publisher

Publisher