What is Bootstrapping?

Bootstrapping means starting and growing a business with minimal resources, often relying entirely on personal savings, cash flow from operations, or other creative financial techniques. Unlike businesses that depend on external funding such as venture capital or bank loans, bootstrapped businesses grow organically, prioritizing self-sufficiency and frugality over rapid expansion.

How Does Bootstrapping Work?

Bootstrapping works by relying on a business’s internal resources and innovative financial strategies to operate and grow. Entrepreneurs typically begin by investing their own savings, pooling resources from friends or family, and leveraging low-cost or no-cost tools to kickstart operations. Instead of seeking external funding, bootstrapped businesses use profits or cash flow from sales to reinvest in growth, ensuring the company scales sustainably.

In practical terms, bootstrapping means keeping operations lean and focused. Founders often wear multiple hats to reduce payroll expenses, prioritize cost-effective marketing methods like social media and word-of-mouth, and negotiate payment terms with suppliers to manage cash flow. For instance, pre-orders or subscriptions are often used to generate working capital before production begins. A survey by CB Insights found that 38% of startups fail due to cash flow issues, highlighting the critical importance of financial discipline in bootstrapped ventures.

Bootstrapping also encourages founders to be deeply customer-focused, as customer revenues are the primary growth driver. According to data from SCORE, nearly 64% of small businesses are started with personal funds, making bootstrapping one of the most common methods of funding. By maximizing creativity, minimizing expenses, and maintaining a close eye on cash flow, entrepreneurs can achieve sustainable growth while retaining full control of their business vision.

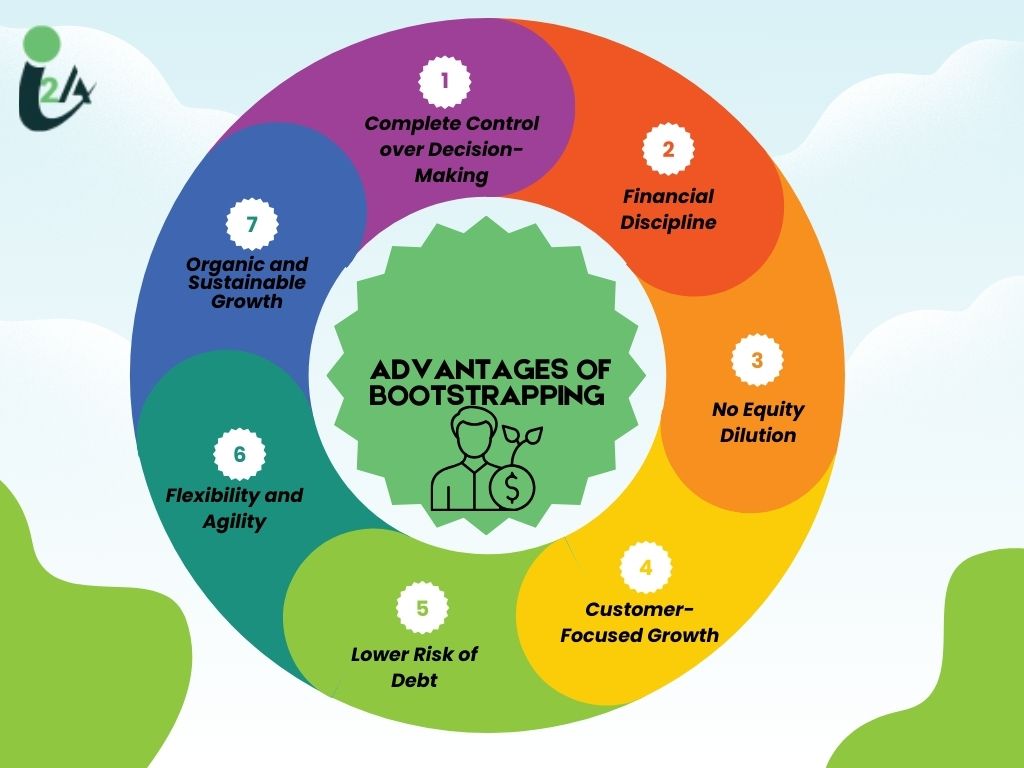

Advantages of Bootstrapping

- Complete Control over Decision-Making: Founders retain full ownership and control, avoiding external investor influence.

- Financial Discipline: Operating on limited resources fosters frugality and better cash flow management.

- No Equity Dilution: Entrepreneurs keep 100% equity, allowing them to reap full rewards from their hard work.

- Customer-Focused Growth: Bootstrapped businesses often rely on customer revenues, ensuring a sharper focus on customer satisfaction.

- Lower Risk of Debt: By avoiding loans or external funding, businesses are not burdened with repayment obligations.

- Flexibility and Agility: Without the need to satisfy external stakeholders, founders can quickly pivot or make strategic changes.

- Organic and Sustainable Growth: Bootstrapped companies grow at a natural pace, reducing the risk of overexpansion.

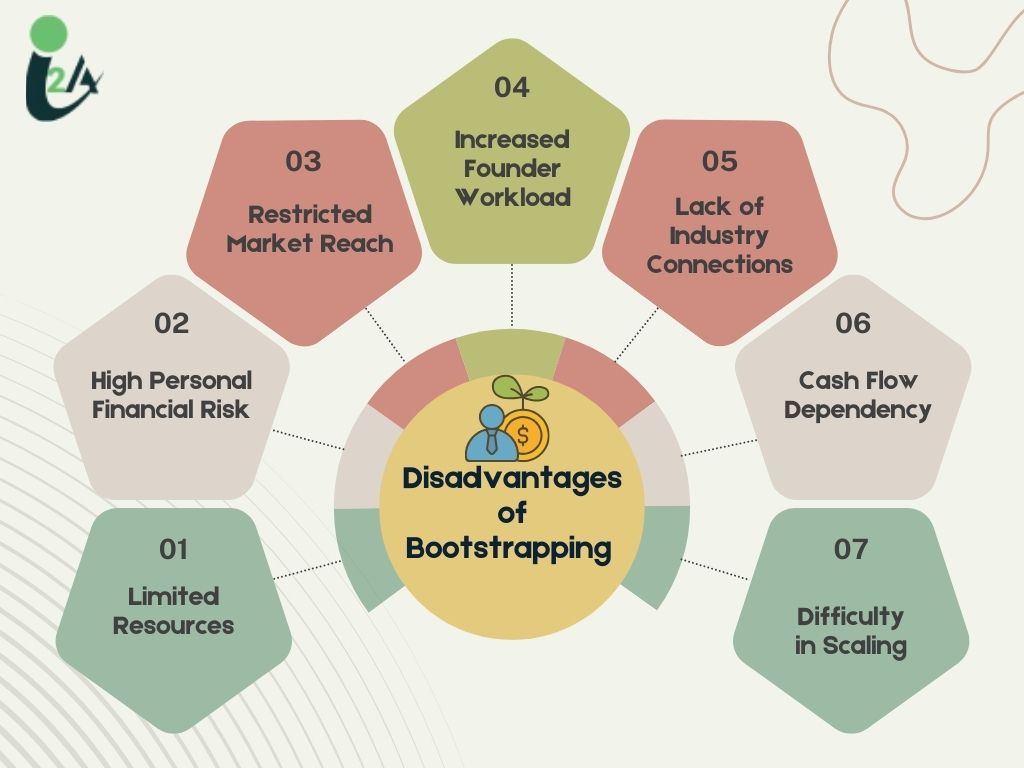

Disadvantages of Bootstrapping

- Limited Resources: Growth is often slower due to the lack of significant capital for scaling operations or marketing.

- High Personal Financial Risk: Founders often invest personal savings, creating potential financial strain.

- Restricted Market Reach: Without large-scale funding, businesses may struggle to expand or compete in larger markets.

- Increased Founder Workload: Founders frequently take on multiple roles, which can lead to burnout.

- Lack of Industry Connections: Without external investors or mentors, gaining access to networks and partnerships can be challenging.

- Cash Flow Dependency: Businesses relying solely on operational revenues can face crises during revenue dips or payment delays.

- Difficulty in Scaling: Limited capital may prevent businesses from taking advantage of high-growth opportunities.

Stages of Bootstrapping

Bootstrapping a business involves several stages, each with its unique characteristics, funding methods, and challenges. Below is a detailed breakdown of these stages:

1. The Ideation Stage

This is the initial phase where the founder develops the business idea, validates its feasibility, and creates a basic business plan. Resources are minimal, and the focus is on building a strong foundation.

Typically funded through personal savings, small loans from friends or family, or leveraging personal credit cards. Some founders may also continue working a day job to fund their venture.

Challenges:

- Limited capital for prototyping or research.

- Balancing personal finances and business needs.

- Gaining market validation without substantial resources.

2. The Launch Stage

At this stage, the business moves from concept to reality. The founder develops a minimum viable product (MVP) and starts acquiring initial customers. Early revenue streams are established.

- How Funds Are Raised:

- Pre-order bookings to generate working capital.

- Small-scale crowdfunding campaigns.

- Merchant cash advances or leveraging business credit.

- Challenges:

- Scaling the MVP with limited funds.

- Generating trust and early traction without a proven track record.

- Managing customer expectations and cash flow simultaneously.

3. The Growth Stage

In this phase, the business focuses on expanding its customer base, improving the product or service, and increasing operational capacity. Growth is often organic and dependent on reinvesting profits.

- How Funds Are Raised:

- Cash flow from operations.

- Invoice financing to manage receivables.

- Strategic partnerships or collaborations for mutual growth.

- Challenges:

- Cash flow dependency for reinvestment.

- Balancing growth with operational efficiency.

- Scaling infrastructure and staffing without overextending resources.

4. The Maturity Stage

At maturity, the business achieves consistent revenue and operational stability. Focus shifts to long-term growth strategies, diversifying revenue streams, and sustaining profitability.

- How Funds Are Raised:

- Retained earnings from the business.

- Profits reinvested into new ventures or scaling existing operations.

- Exploring low-risk financing options if needed for significant expansion.

- Challenges:

- Maintaining a competitive edge in a crowded market.

- Innovating without overspending.

- Managing the risks associated with expansion or diversification.

5. The Exit or Expansion Stage

At this point, the founder may either scale significantly, seek external funding, or plan an exit strategy through acquisition or partnership.

- How Funds Are Raised:

- External funding options like venture capital or private equity (if chosen).

- Strategic alliances to enter new markets or develop new products.

- Challenges:

- Deciding between scaling or exiting.

- Balancing the original vision with potential investor demands.

- Maintaining operational efficiency during rapid scaling.

Bootstrapping vs Other Funding Options

| Aspect | Bootstrapping | Venture Capital | Bank Loans | Crowdfunding |

| Definition | Using personal funds, business revenue, or creative methods to fund the business. | Funding from investors in exchange for equity in the company. | Borrowing money from a bank with an obligation to repay with interest. | Raising small amounts of capital from a large group of individuals online. |

| Ownership | Founder retains 100% ownership and control. | Investors take equity, reducing founder’s ownership. | No equity is lost, but debt obligation exists. | No equity is lost, but expectations for rewards or perks may exist. |

| Financial Risk | High personal financial risk. | Low personal risk, but loss of control over decisions. | Moderate risk due to repayment obligations regardless of business success. | Low financial risk, but failure to meet backer expectations can harm reputation. |

| Flexibility | Maximum flexibility; decisions are solely founder-driven. | Limited flexibility due to investor oversight and influence. | Limited flexibility; strict repayment schedules. | Moderate flexibility; backer preferences can influence project direction. |

| Growth Speed | Slower, organic growth. | Rapid growth enabled by substantial funding. | Moderate growth, dependent on loan amount and repayment terms. | Variable growth, based on the scale of crowdfunding success. |

| Cost | Minimal cost; relies on internal resources. | Loss of equity; significant opportunity cost. | Interest payments add to business expenses. | Costs include platform fees and fulfillment of promised rewards. |

| Decision-Making | Founder has complete decision-making power. | Investors often influence key business decisions. | No influence on decisions, but financial obligations limit flexibility. | Decisions can be impacted by promises made to backers. |

| Scalability | May struggle with rapid scalability due to limited resources. | Highly scalable with investor capital. | Scalable within the limits of the loan amount. | Scalable, but depends on campaign success. |

| Time to Secure Funds | Immediate (from personal funds or revenue). | Lengthy process involving pitching and due diligence. | Moderate; dependent on loan application and approval process. | Moderate; dependent on campaign timeline and funding target. |

| Examples | Apple, Mailchimp, Spanx. | Facebook, Airbnb, Uber. | Small and medium-sized businesses (traditional industries). | Oculus Rift, Pebble Watch. |

This table provides a clear and concise comparison of bootstrapping and other funding methods, helping founders choose the option that aligns best with their goals and circumstances.

Strategies for Successful Bootstrapping

Entrepreneurs use a variety of methods to fund their businesses during the bootstrapping phase.

- Personal Loans: Borrowing from personal savings or taking small loans from friends and family.

- Business Credit Cards: Leveraging credit cards for initial purchases and expenses.

- Cash from Operations: Reinvesting profits directly back into the business.

- Pre-Order Bookings: Generating revenue upfront by accepting orders before product completion.

- Merchant Cash Advance: Obtaining cash by selling future revenue streams.

- Invoice Financing: Borrowing against unpaid invoices to maintain cash flow.

- Operating on Credit: Building supplier relationships that allow deferred payments.

These techniques, while diverse, share the common principle of maximizing internal resources and minimizing external dependency.

Examples of Bootstrapping

Many iconic companies began their journeys through bootstrapping. Apple was famously started in a garage by Steve Jobs and Steve Wozniak with personal savings and profits from their early sales.

Spanx founder Sara Blakely bootstrapped her way to success with $5,000 in savings and no formal marketing budget.

Mailchimp, the email marketing giant, operated without external funding for over 20 years before becoming a billion-dollar company.

These stories highlight how ingenuity and determination can drive success without outside capital.

Challenges Faced by Business in Bootstrapping

Bootstrapping comes with its fair share of challenges. The lack of significant capital often restricts growth opportunities, leaving entrepreneurs juggling multiple roles to stretch limited resources. Cash flow management becomes a critical issue, as delays in payments or unexpected expenses can disrupt operations. Additionally, the pressure to succeed without external support can lead to burnout, with founders shouldering both financial and operational responsibilities. Despite these hurdles, bootstrapping teaches resilience and financial discipline, invaluable skills for long-term success.

Amit Chauhan’s View on Bootstrapping

Bootstrapping empowers entrepreneurs to build businesses with limited resources, emphasizing creativity, financial discipline, and customer-centric growth. While it comes with challenges such as resource constraints and personal risk, it fosters resilience and ownership. By understanding its stages, strategies, and trade-offs, founders can leverage bootstrapping to create sustainable, innovative ventures. This approach not only nurtures independence but also instils the agility needed to adapt and thrive in dynamic markets.

Publisher

Publisher